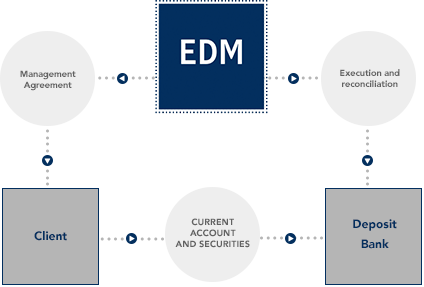

Coinrule was founded in 2013 by two former traders, David and Alex. By purchasing and using our Forex robots, you get not only just a working product. You get a complete service which includes the most important things such as 24/7 support, guarantee, free updates and last, but not least, a transparent and clear price policy. “Agent” affiliates program is intended for both individuals and companies and doesn’t require any initial investments or deep knowledge about Market. Multi Exchange Back Office solution carry out functions like settlements, record maintenance, compliance, various reports and accounting.

Algorithmic trading is also known as Robo trading or automated trading system. Algo Trading uses various mathematical models to execute the most profitable trades based on market data. Algo software is a buy and sells signal where a human trades using automated buying and selling decisions.

So, you can dedicate some of your portfolio to copying a stock trader, some to copying a crypto trader, and some to copying long-term investor. The options for diversification and customization are nearly endless. It doesn’t matter whether you are a beginner or an experienced trader, you can use AlgoSmart to receive important trend signals. AlgoSmart provides a wide range of useful features to create quantitative trading strategies.

It will help you find the best automated trading software that will perfectly suit your trading requirements and styles. These are very generalised examples and the quality of the automated trading software available to retail traders does vary enormously. Trend Spider is an AI trading software that finds profitable trend trading opportunities in the stock market. The program was created by Dan Ushman, a former trader who wanted to make it easier for people to find great trades.

Orders are triggered instead by signals from expert traders or from algorithmic trading bots . TeslaCoin is both a cryptocurrency and one of the best auto trading platforms for crypto. With TeslaCoin, you can trade popular cryptocurrencies like Bitcoin, Ethereum, and Bitcoin Cash automatically. Let’s take a closer look at the 5 best automated trading platforms so you can decide which one is right for you.

This heavily regulated online broker allows you to trade over 80 forex pairs – covering a wide variety of majors, minors, and exotics. Finally, it’s also worth checking out the Learn2Trade website – where you will find hundreds of free educational guides and courses. If you like the sound of Learn2Trade but want to test the waters out first, the provider offers 3 free signals per week.

Trading Knowledge A professional trader should possess a good knowledge and understanding of the stock market. To enhance it you can read books related to investing, try some trading strategies in the live market, follow some blogs, listen to podcasts, and get knowledge from other resources. World time differences mean that on weekdays, trading takes place 24 hours per day and human traders cannot physically maintain constant attention for that length of time.

Zerodha Streak

AI trading is a method of using algorithms and artificial intelligence to pick high-performing investments based on your preferences. The idea behind this type of automated trading is that it can provide an investor with more confident, safe, and profitable trades than they could achieve themselves. Moreover, the best part about this technical analysis software is that users don’t really need to have any additional knowledge regarding fundamental or technical analysis. The software itself will assist you in making profitable trading decisions.

Once a customer has sufficient funds to invest, SquareOff proprietary execution algo would take care of execution. Not much manual intervention required from the customer, they can continue with the day job or business while our platform would take care of their executions. Our algorithm will be mapped to your account, whenever algo triggers an order it will be replicated in your account automatically. “As a sub broker, we needed a reliable trade copier service that our clients could use, as problems cost us money for in house dealer. We have been using Robotics for over 2 years now for accounts ranging from to Rs.10L and found the overall service incredibly robust”.

- The main issue with ALGO trading is that some platforms are not designed.

- This helps traders watch trends, set their strategies, and execute them in the best way possible.

- If algorithmic trading is done with discipline and using the right strategies, it is a good long term career option.

- Upstox Pro offers powerful customizable charts with a duration from 1 minute to 10 years of history and a facility to draw 107 indicators.

- TradeTron Tech Pricing – TradeTron offers a free plan and four paid plans starting from ₹ 300.

- If you have questions about copy trading, eToro offers 24/7 customer support.

Users can define their own strategies or use the pre-defined strategies offered by the software. In addition to this, traders can also use multiple strategies while trading which can be paused, stopped, or changed as per the user’s convenience. Let’s check out a list of the best algo trading software in India with its pros and cons.

Q2. Which ALGO is best for trading?

In addition to this, this software also enables traders to customize their strategies by combining certain parameters, with zero coding. Investors and traders use trading software for its automated trading capabilities and systems. There are other options such as chatrooms, proprietary tools, data charts and indicators for doing technical analysis. As such, another option to consider in the world of automated trading is that of a signal service provider.

Typically, you must have money set aside in an auto-trading account. Only you have the ability to withdraw these funds, but your automated trading software has custodial access to place trades in the account. The best auto trading platforms partner with regulated brokers to ensure your trading account is secure. Masterswift2.0 stock trading software offers back testing that helps users to test their trading strategy against already available historical data. This help you to minimize risk and know if your strategies are working in the direction or not. In addition to this, masterswift2.0 comes with other technical analysis tools including advanced charting options, pattern recognition, scanners, and more.

It’s another algo tool from Zerodha and also provides excellent features for traders. It was launched in 2013 and is considered one of the oldest algo software for trading in the Indian stock market. If you want to automate backtesting, automated trading software in india it’s the automated tool you can prefer. Many attractive features are available to make your trade effective, but some of them are paid too. This tool can be highly beneficial in technical analysis and has sturdy customer support.

Email: support@keyresearch.in

The introduction of best ALGO trading software in India was a game-changer for traders looking for a more efficient way to trade in shares and other financial instruments. They can now trade without dealing with markets and exchange rates, which require a lot of time and effort. To make sure they don’t lose money, investors must learn how to use ALGO trading platforms correctly and take advantage of their features.

Open Account

As we covered earlier, signal platforms like Learn2Trade have the functionality to send trading suggestions throughout the day. These suggestions are sent out by a team of experienced traders that manually scan the markets via chart reading tools and technical indicators. The platform is targeted at experienced traders rather than beginners. With that said, the NinjaTrader Ecosystem does contain over 100+ automated trading strategies that can be installed directly into the platform via an API. Traders can set their own algorithms that can buy and sell orders when the desired conditions are met.

If opting for automated trading signals, then you will need to pay a monthly subscription fee. After all, the signal provider will be scanning the markets on your behalf and telling you what trades to place. If opting for an automated trading platform that allows you to copy a trader like-for-like, there is every chance that a revenue share fee will be in place. This means that the trader will collect a percentage of all profits that it makes for you.

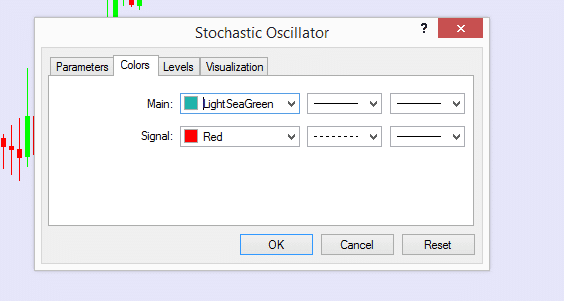

Now i want to try auto trading to eliminate emotional part out of it and using my knowledge of technical analysis to profit. I trade on hourly n daily charts using multiple time frames n multiple indicators. VectorVest technical analysis software assists traders in deciding what and when they should buy and sell.

The Options Trading bots are designed to act upon the movement of market trends, providing users with a hassle-free experience and assured profits. Algorithmic trading is a form of automated investing that lets you test out strategies before putting real money on the line. This gives traders invaluable insight into whether or not their strategy will work. ODIN allows traders to auto-execute trades based on their selected strategies.

This will, of course, attract brokerage commissions and fees, which you will normally need to pay every time a trade is placed. Once your account is verified, you will be able to deposit funds into your account. In terms of the specifics, Forex.com – which is US-friendly, has no minimum deposit in place when finding your account via bank wire. Either way, you can choose from several accounts – one of which offers commission-free trading.